Top 5 Considerations for Sellers

Share:

What’s the real deal? The state of your processes and systems matters in M&A. Here’s how to prepare for valuations and due diligence.

M&A activity remains strong in the accounting industry – and, it is likely just the beginning of a long race to obtain capital and competitive advantage. The need for partner exit strategies and growth capital are driving the seller’s side of the equation, and firms hungry to grow through acquisition, along with the entrance of private equity investors, are driving the buyer’s side. Plus, the accounting industry is ripe for roll-up, having never undergone a major consolidation like so many other sectors have.

If you’re looking to sell, getting a good price for your firm in a market filled with options involves more than hanging a for-sale sign out front. For those looking to be acquired, preparation – long before approaching potential buyers – is becoming essential for streamlining the process and improving outcomes.

Here are the Top 5 things to consider when you’re trying to be acquired:

1) Is your revenue house in order? One of the first things a prospective buyer will examine is your P&L. If you’re lagging on billing and revenue collection, then you could be missing out on a chance to bump up the value of a deal. Your firm will be more attractive to a buyer if your accounts receivables are fully received and your aging report looks good.

2) Are you as profitable as you could be? Almost every valuation can benefit from an efficiency play, since high administrative costs and low productivity can erode your bottom-line. If your firm is suffering from slow month-end closings, cumbersome manual processes, and the inability to gain actionable insights, then you could be leaving money on the table. The tighter your operations; the higher the valuation.

3) Have you attempted to eliminate any ugly surprises? From under-funded retirement plans to flat out embezzlement, there may be some unpleasantries hiding in your books. How do such things escape the eyes of managing partners? Disparate and aging legacy systems often don’t provide managers with the transparency they need. Nor do they enable buyers to perform the necessary due diligence. It’s better to take a hard, introspective look yourself before shopping the firm around to a buyer.

4) Are your data and systems integrated or are they held together with the IT equivalent of duct tape and glue? Many firms, whether they’ve grown through acquisition or not, find themselves with a complicated environment of disparate, unintegrated systems because they’ve built their own, relied too heavily on spreadsheets, or purchased siloed, point solutions to solve issues as they arise. Buyers increasingly do not have the time or the inclination to unravel a tangled legacy environment. They want to be able to quickly understand your IT systems and to align your data with theirs with minimal hassle.

5) Are you poised to keep growing? An existing pipeline, along with the scalability and flexibility to accommodate new clients, are important to buyers. Aging, on-premises systems can be costly to integrate, update, and expand, especially when merging with another entity. In some instances, the limitations of the legacy systems, and their inability to support growth, can stop a deal in its tracks.

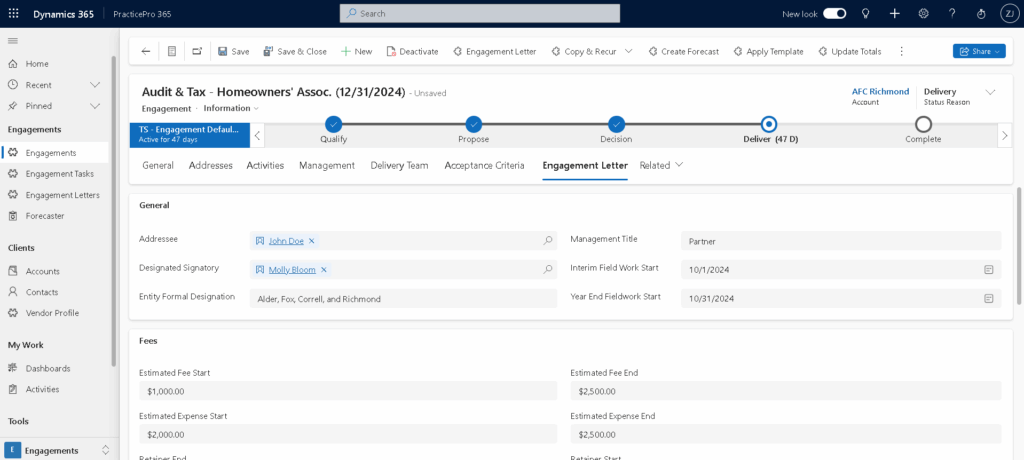

All of these considerations point to the need for a unified, all-in-one Practice Management system that quickly gives both buyers and sellers a view of the business based on reliable, real-time data. While technology isn’t a panacea for everything related to a successful deal (i.e., cultural compatibility still plays a big role), it goes a long way toward addressing the operational and informational aspects.

A unified, plug-and-play, cloud-based system like PracticePro 365 is easy to use and it can be accessed from anywhere. With a single source of truth and infinitely customizable dashboards, it enables you to track billings, receivables, time entry, work-in-progress, customer data, sales pipeline, and more, so you can eliminate any sticking points prior to due diligence and valuation assessments. Plus, with its familiar Microsoft user interface, both buyers and sellers can check the pulse of the business in real-time, and dive into the details when needed with interactive query capabilities. PracticePro 365 also eliminates the need to invest separately in automation, analytics, mobility and security – all of which are “baked in” to the system.

For these reasons, having a unified cloud-based system is essential for getting top dollar for your business. A disparate legacy system environment is simply not something buyers want to inherit since it limits the firm’s ability to grow and scale. Nor is it favorable for developing and retaining up-and-coming talent, which is essential for sustaining the organization.

Contact us for a PracticePro 365 demo and to see how a unified cloud-based system can help you turbocharge your exit or growth strategy and maximize your valuation in an M&A market that is hot – and getting hotter.