Trusted by Leading Accounting Firms, PracticePro 365 is the Practice Management Solution Perfect for Private Equity Investors and M&A deals

Successful accounting firms invest in automation, analytics, and mobility — all of which are built into PracticePro 365’s DNA. Be among the thousands of accounting professionals who trust PracticePro 365 as their partner in growth.

When TOP 50 Accounting Firm MGO was looking for a practice management solution to support its robust growth and M&A strategies, they chose PracticePro 365.

“MGO was searching for an all-in-one practice management solution. We chose and implemented PracticePro 365, the secure, cloud-based platform, to seamlessly manage client relationships, unify disparate software, and drive our growing practice.”

When Accounting Firm MGA was searching for a solution to better manage their practice, they chose PracticePro 365.

“We do not look for software. We look for solutions. Our decision to work with PracticePro 365 was in our alignment as a partnership. We are better together, and that is what stands at the foundation of any of the strategic relationships we work to create.”

The All-in-One Tool for Effortless PE and M&As.

Go from chaos to order with a unified cloud-based system designed to scale, integrate, and support mergers and private equity partnerships.

Practice Management Software for Accounting Firms Designed to Help You Scale Without Setbacks.

Seamless Data Integration: All Your Data, One Place

Cut down on wasted time to speed up successful transitions. Consolidate data and say goodbye to inefficiencies that disrupt important PE and M&A decisions.

Work Smarter

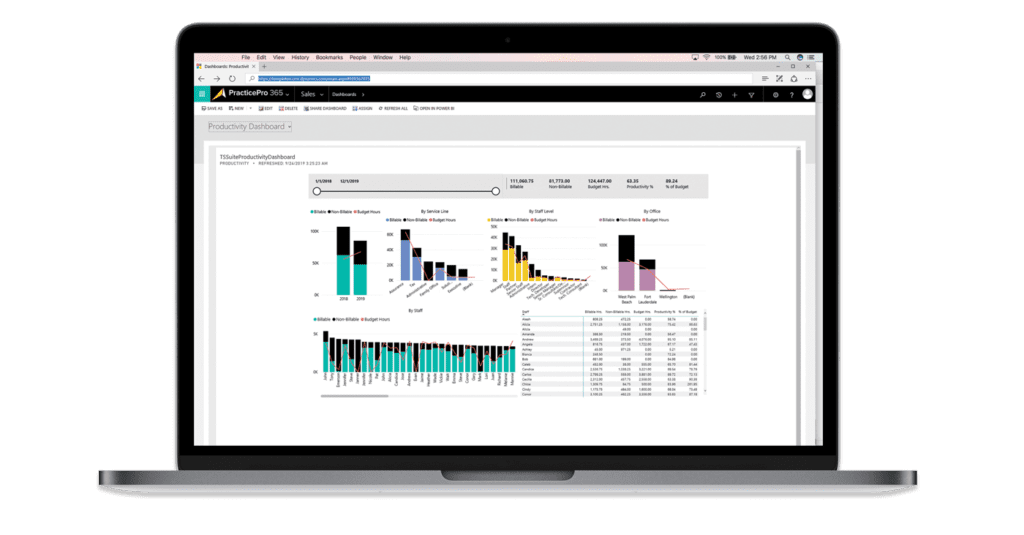

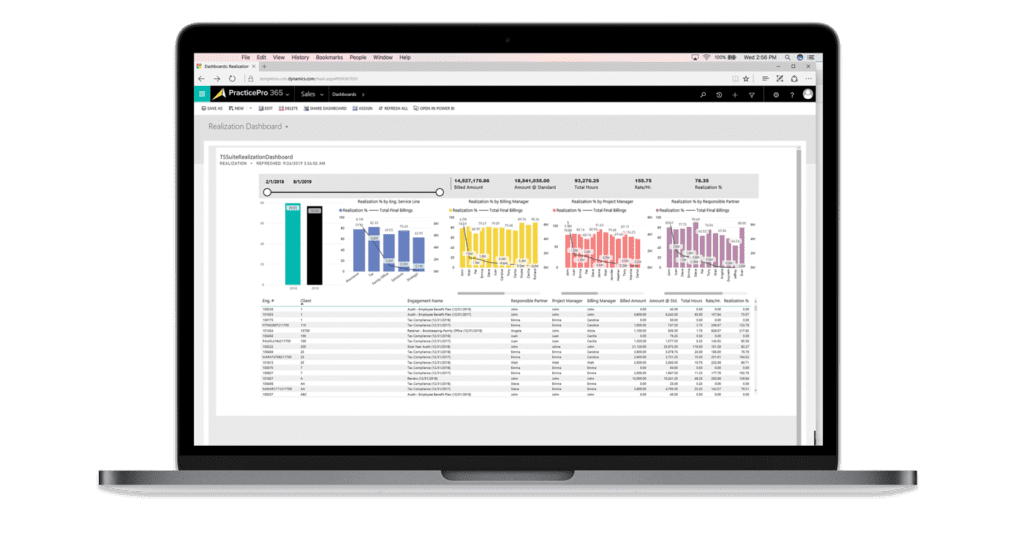

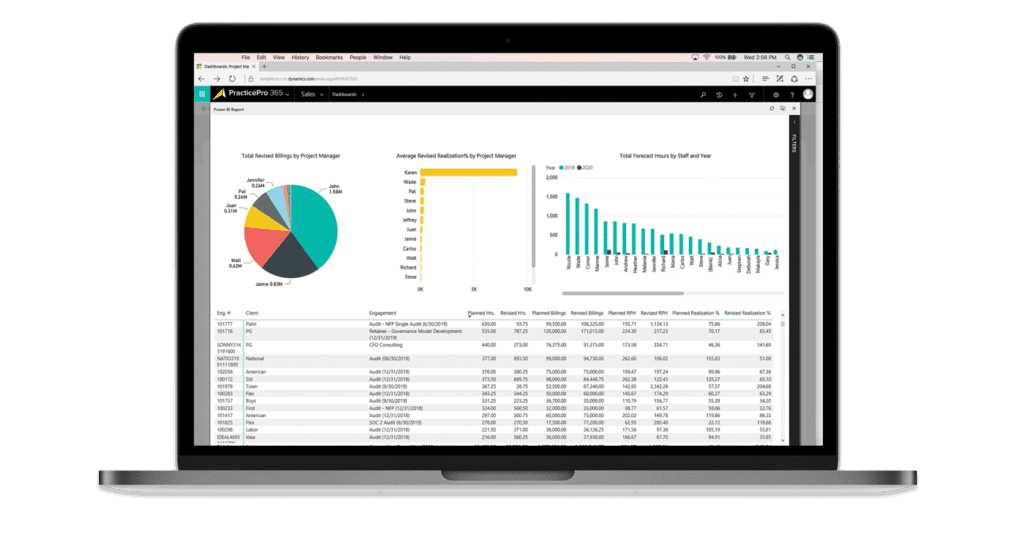

Manual work is a thing of the past. With built-in automation, you’ll simplify operations, streamline productivity, and strategize your growth using deep analytics.

Effortless Scalability: Expand Without a Hitch

Get a system that scales with you. On-premises systems cost to grow, expand, and update. PracticePro 365 is flexible. It evolves with you and your acquisitional growth, making it easy to manage increasing users and data without limits.

Teaming up with new employees across the world? No worries. Enjoy secure, flexible access from any device, wherever you are, in real-time.

Cut down the clutter. Replace multiple systems with one. Watch your overall expenses reduce and your bottom line improve.

Solutions Made for Accountants, By Accountants.

You think in numbers, data, and results. So does PracticePro 365.

Try it out Today!

Try it on to see if it fits. Request a demo today and experience how PracticePro 365 can transform your growth before you commit.

Still Have Questions? Let Us Answer Them.

Not with PracticePro 365. Our smooth migration process and dedicated support ensure a hassle-free transition.

Check in with us to see how much you can save by replacing your firm’s various legacy systems and their related fees with PracticePro 365’s all-in-one solution. The initial investment pays off with major long-term savings, both financial and operational, by consolidating systems, speeding up processes, and improving data reporting.

Security is a top priority for PracticePro 365. That’s why we developed PracticePro 365 on the Microsoft platform that provides an exception level of security. Each year we undergo a SOC 2 audit verifying that PracticePro 365’s information security practices, policies, procedures, and operations meet the SOC 2 standards for security, availability, and confidentiality.

Of course. Book a call below to see how PracticePro 365 can drive your success, streamline your operations, and support your M&A or PE accounting goals.