3 Data Insights That Will Change How You Manage Your Accounting Practice

Share:

Accounting leaders, like everyone else, are awash in data these days. Unfortunately, that doesn’t always mean they have what they need to make informed decisions and take beneficial action. Often, the right information just isn’t easily accessible. And even if it exists, it may be out of date or siloed in a way that makes viewing it in a meaningful context impossible.

But what if that weren’t the case? How would your firm change if you could see the facts that remain out of reach? Imagine having easy access to:

1. Industry data

Clients are the lifeblood of any accounting firm, and they often represent a variety of industry sectors. What is your firm’s revenue by industry? Which industries are most profitable? The reality is that most firms can’t piece together truly accurate answers to those questions. If your firm tracks clients’ industries at all, that data point would almost certainly be noted only in your CRM, which is separate from billing and revenue. Industry insights would require digging through data stored in various systems and locations, and then organizing and compiling it in an Excel-like tool for calculations and presentation. Overall, an extremely inefficient and wasteful process.

But if that information were at hand in an instant, you’d have a clear view of the pipeline you should focus on to grow the practice. You’d be able to pull together stats for new business proposals without going through a fire drill each time. You could easily communicate with clients from specific sectors or create industry-focused events for clients and prospects to grow the practice.

The ability to report revenue in different ways helps you see the forest through the trees, showing you what drives your business and helping you identify and act on growth opportunities you may be missing out on today.

2. Budget-to-actual

A sad fact: The most commonly used project management tool for accounting firms is Excel. Comparing budget to actual requires an elaborate process of downloading time and getting it lined up correctly with the established project budget. The hassle frequently means projects exceed budget before anyone notices, so you have to suffer the lost revenue or deliver bad news to the client after the fact.

Now imagine that instead of enduring a laborious process to see where projects stand, you have job hours instantly and automatically compared to budget, letting you see how time spent compares with your plan. Suddenly the excuse for undetected budget overruns vanishes.

Managing partners hold teams responsible for creating and abiding by budgets, but how can they when they’re operating in the dark? Tools that offer real-time visibility into projects let your people manage plans more responsibly, correct course when necessary, service clients more effectively and, ultimately, grow the business.

3. WIP

Every firm has some good billers and some who tend to procrastinate. Cash flow suffers when managing partners don’t know who is sitting on significant unbilled work-in-progress. What’s worse, when bills arrive long after work is complete, clients have often forgotten about the great service they received and may resent or even contest fees.

Real-time WIP data lets managing partners see who’s billing and who’s not, so they can motivate procrastinators. For those who don’t take billing as seriously as they should, providing the facts they need to do the job easily can make a big impact on how often billing occurs. Billing data that’s visible well before the rigmarole of closing a period helps everyone build healthy billing habits.

Data makes the difference

How do you know where to go if you can’t see where you are? When key data takes just the push of a button rather than a protracted struggle, the benefits are transformational. Applying this kind of information to project management, strategic business positioning or billing allows you to dramatically improve profitability and increase your competitive edge.

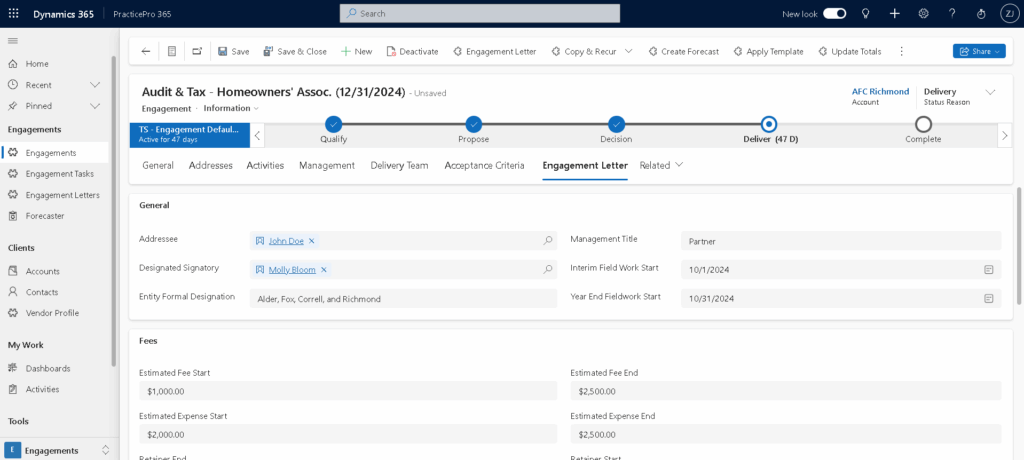

To learn how to gain real-time access to these and other critical data points, request a demo of PracticePro 365.